does instacart take taxes out of your check

The IRS establishes the deadlines for the payment. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart.

What You Need To Know About Instacart Taxes Net Pay Advance

You can save 25 to 30 of every payment and put it in a different account to make saving for taxes easier.

. If you are looking for a hands-off approach to dealing with your Instacart 1099 taxes try Bonsais 1099 expense tracker to organize your tax deductions online. You can even write-off from your taxes the cost of hiring a tax professional if needed - this is optional if you seek out tax advice but highly recommended. To pay your taxes youll generally need to make estimated tax payments.

The estimated rate accounts for Fed payroll and income taxes. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. Plan ahead to avoid a surprise tax bill when tax season comes.

Estimate what you think your income will be and multiply by the various tax rates. Register your Instacart payment card. You might also want to check the insurance laws where you are in many places you actually need commercial insurance on your vehicle for delivery gigs.

So if you received a form that means you. Youll have to pay that 765 twice over for a total of 153. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. Of course many people have received theirs earlier than the ten days or at the scheduled time without issue. If you earned 600 or more in 2021 through Instacart in the US Stripe will send an email titled Confirm your tax information with Instacart inviting you to create an account and log in to Stripe Express.

Does Instacart take out taxes for its employees. One sneaky Instacart shopper trick is to scan your shopper receipts with a variety of reward apps. Instacart shoppers use a preloaded payment card when they check out with a customers order.

Every minute spent figuring out your taxes is one more dollar in your pocket. Unlike in-store shoppers full-service shoppers dont have their taxes withheld. Use Receipt Reward Apps.

Then if your state taxes personal income youll need to find out the tax rate for your state and withhold accordingly in addition to the 20 minimum for your federal taxes. For simplicity my accountant suggested using 30 to estimate taxes. Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order.

Report Inappropriate Content. This can make for a frightful astonishment when duty time moves around. This is sometimes also known as quarterly taxes.

We suggest you put a reminder on your phone. 20 minimum of your gross business income. This is a standard tax form for contract workers.

To make matters worse thats on top of your federal and state income taxes. If there are any unforeseen circumstances this process could face even longer delays. The tax andor fees you pay on products purchased through the Instacart platform are.

Except despite everything you have to put aside a portion of the. According to Instacart their background checks carried out by Checkr could take an average of ten days. Youll also have to contend with self-employment tax.

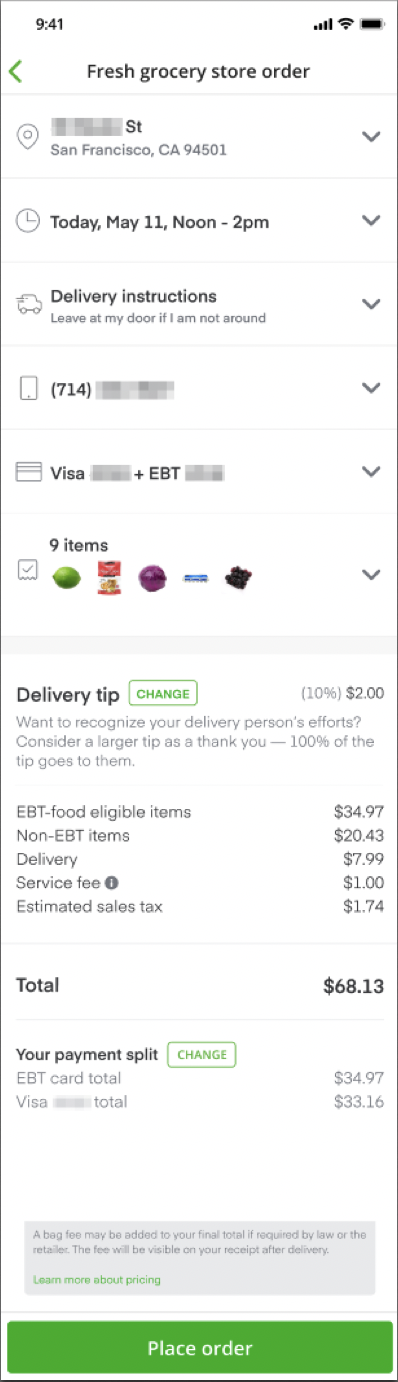

If your order includes both taxable and non-taxable items instacart consists of an estimated breakdown of the taxes included within your order total at checkout. I worked for Instacart for 5 months in 2017. Its a completely done-for-you solution that will help you track and.

Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. Instacart does not take out taxes at the time of purchase. As an Instacart driver though youre self-employed putting you on the hook for both the employee and employer portions.

Youll have to file and pay them yourself. Tax withholding depends on whether you are classified as an employee or an independent contractor. What percentage of my income should I set aside for taxes if Im a driver for Instacart.

If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. Deductions are important and the biggest one is the standard mileage deduction so keep track of. Stripe Express allows you to review your tax information download your tax forms and track your earnings.

Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. Your taxes will be more complicated because youre treated as an independent contractor not an Instacart employee. Instacart does not take out taxes at the time of purchase.

To make saving for taxes easier consider saving 25 to 30 of every. I earned 600 or more in 2021. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Instacart shoppers are contractors so the company will not deduct taxes from your paycheck. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file.

You see there are numerous apps out there that pay you with PayPal cash or free gift cards in exchange for buying products from partner brands and uploading receipts as proof of purchase. Missing quarterlydeadlines can mean accruing penalties and interest. One sneaky Instacart shopper trick is to scan your shopper receipts with a variety of reward apps.

Look for the PDF for 1040ES theres a pile of instructions and a worksheet in there to determine what you need to do -. Gig platforms dont withhold or take out taxes for you. Do I have to file taxes for Instacart.

The total amount including all applicable taxes will become charged to your payment method on file when you receive your order. Do Instacart Shipt Postmates DoorDash or other platforms take out taxes. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits.

Pay Instacart Quarterly Taxes. Part-time employees sign an offer letter and W-4 tax form. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

Depending on your location the delivery or service fee. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C. Reports how much money Instacart paid you throughout the year.

The base 399 fee can be marked up by 2-4 if you want priority faster delivery. New shoppers can expect to receive their card within 5 to 7 business days. Missouri does theirs by mail.

All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year.

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How Much Can You Make A Week With Instacart 2022 Real Earnings

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Reviews 1 953 Reviews Of Instacart Com Sitejabber

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart 1099 Taxes

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Fees Everything You Ll Pay As A Customer Explained

Instacart Help Center Checking Out With Your Ebt Card

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

What Can I Write Off On My Taxes For Instacart Taxestalk Net